When Startups Fail: A first look into the causes of startup failure in the MENA region

By Matt Smith written for Wamda in collaboration with Autopsy

Nearly a century ago, Henry Ford said that failure was simply the opportunity to begin again, this time more intelligently. Many entrepreneurs have heeded the legendary carmaker’s advice, overcoming early difficulties before succeeding, but the concept of embracing failure is less accepted in the region’s startup sector — increasing the chances of companies going bust.

“When people become an entrepreneur they almost train themselves to not even consider that failure is possible. It’s like the athlete who thinks only of winning. Failure isn’t an option,” says PK Gulati, a Dubai-based entrepreneur and investor. “In the real world, though, no matter how hard you work you may still fail. When that happens, the entrepreneur is ill-prepared, and they fail hard. There is a very large personal cost, which usually burns them out in the sense they stop seeing entrepreneurship as a viable career choice.”

There’s no doubting that entrepreneurship is tough, with a US study of 3,200 high growth technology startups finding that over 90 per cent failed within three years.

So why do so many new companies fail? London-based data analytics firm Autopsy, which has the largest database on startup failure globally ranging from pre-seed to series A and beyond, compiled data exclusively for Wamda.

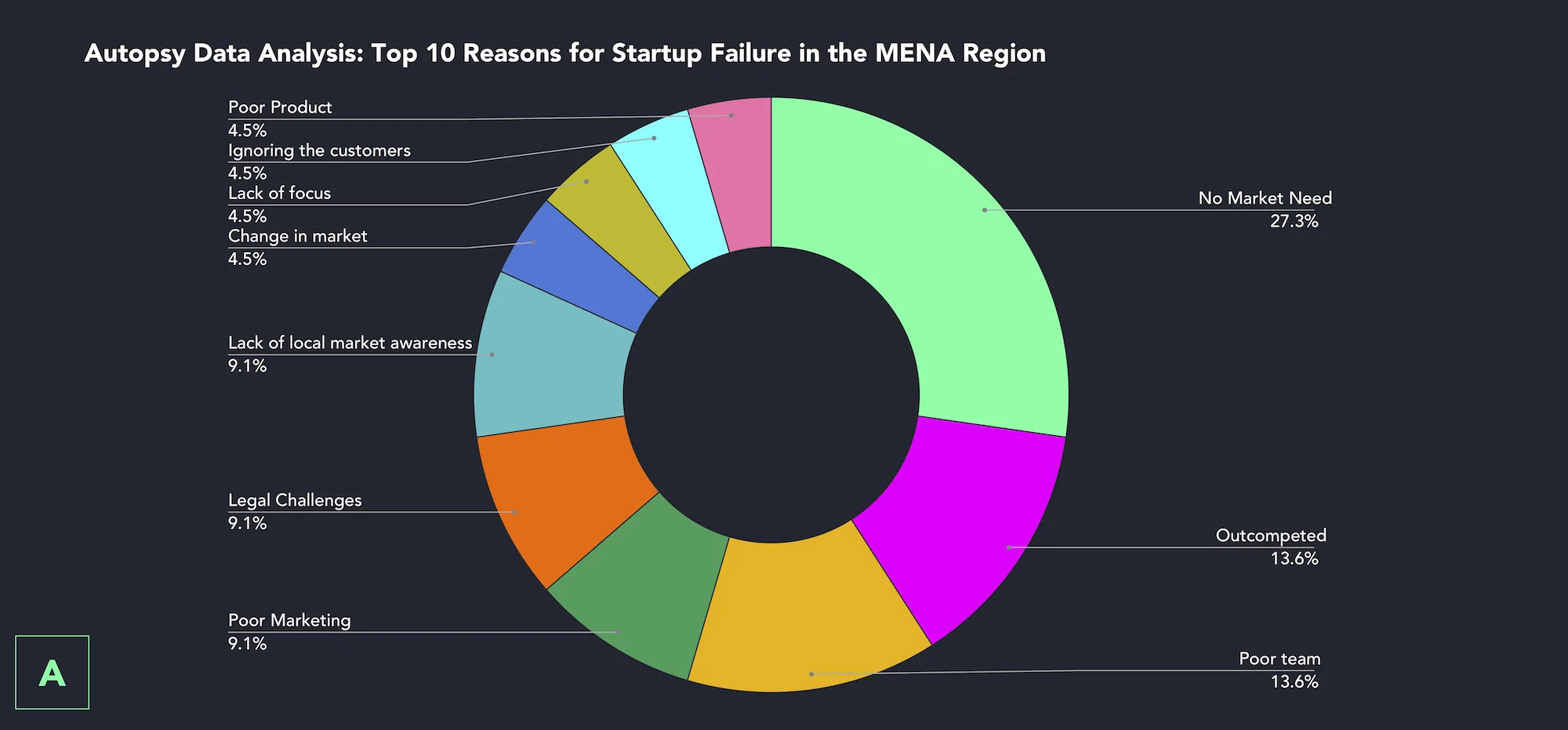

Autopsy Data Analysis: Top 10 reasons for startup failure in the MENA region

Autopsy analysed more than 60 failed startups in the Middle East and North Africa (Mena) region — principally from Saudi Arabia, Egypt, the UAE and Iran — to establish the common reasons for failure. No market need (27.3 per cent) was cited as the most common cause, followed by outcompeted and poor team (both 13.6 per cent). Poor marketing, legal challenges and a lack of local market awareness were each cited by 9.1 per cent of companies, while change in market, lack of focus, ignoring customers and poor product were each blamed by 4.5 per cent.

Among the failed companies, the three most represented sectors were e-commerce, advertising and software. The highest funded company included was Dubai-based Zibox Inc. a marketplace for buying and selling used items, which received $1.9 million in seed funding.

“There tends to be a trend of replicating similar business models of successful startups in Europe and US to cater for the Middle eastern audience,” says Maryam Mazraei, founder and chief executive officer at Autopsy.

Yet these successful models won’t necessarily work elsewhere, hence why a lack of market need is a commonly-cited reason for business failures, she adds.

Startup MBA

Today, Nada Zagallai is Uber’s head of marketing for the Middle East, but she began her entrepreneurial career at Saudi Arabia’s Sada Shop, one of the region’s first e-commerce sites. Two experienced Saudi-based designers founded the company in 2009 with the aim of creating a high-end shopping platform. Aged 26, Zagallai joined as co-founder and manager before it had launched operations.

“Over about three years we built our customer base, an inventory, we optimised our web content, developed our social media presence,” says Zagallai. “We reached a peak about 18 months after going live. After that point, we ran out of gas and had no more funding. We tried to get more, but back then in 2012 the ecosystem was almost non-existent.”

The company closed down the following year.

“I felt an emotional loss,” says Zagallai. “It was my baby. I had spent three years building it up only to then tear it down in three weeks. It felt demoralising. It was distressing. I was younger, so wasn’t equipped with the right mindset to understand that I’d be better for this experience.”

Now, though, she describes her time with Sada as her MBA in the digital sphere, equipping her with skills that would prove invaluable in her subsequent career.

“It was my business education. I have no regrets, although I would change a lot, I wouldn’t exchange anything,” she says.

Asked for what advice she would give company founders facing the failure of their start-up, she says: “Talk to someone else who has been through it. Identification, relatability ease the pain. Know that it passes. And that it actually becomes a stepping stone to something else. As you’re going through the demise of your business, it feels like the end of your world, but it never is.”

Bad Example

In closing Sada, the company settled its obligations and having received seed money from family friends it was an amicable ending, but when failure occurs at unscrupulous or unprofessionally managed companies there be can dire consequences for all involved.

Among the most notorious Mena examples is Fortress Prime, a financial services company that claimed to be a leading clearing house in the Middle East and Asia. Suppliers and partners complained of non-payment while its managing-director Hamed Ahmed El-Barki was arrested for fraud. A US national and convicted felon, he remains on the FBI’s wanted list and is suspected of fraud.

In February 2009, Intel Capital invested in Dubai start-up ConservusInternational, which provided internet-based concierge services to hotel guests. The following September, founder and chairman Kamal Nasser boasted of having two more US companies wanting to invest in his firm. He said his clients included various hotel chains such as Jumeirah, Fairmont, InterContinental, Hilton and Raffles.

But behind the brash hyperbole, the company was struggling to make good on its claims, according to a former employee who spoke on condition of anonymity.

“It started as a one-man business and remained that way. It wasn’t properly managed. It was a really stressful working environment,” says the ex-software engineer.

“We never had a team behind the product. He had an idea and had some business experience, so was able to get contracts with some Dubai hotels, but he never cared about creating a strong team to properly develop the product. That’s why it failed. He just wanted to find an investor to sell out to.”

The company closed down in 2011, according to Crunchbase. Conservus, like many other startups before and since in the Middle East, appears not have adequately prepared for failure, a trait that is damaging to the broader entrepreneurial ecosystem.

“In the West, failing startups will often use the last of their money to legally close the business, pay off their creditors and reach an understanding with their investors and explain what happened. They ensure there are no outstanding liabilities,” says Gulati. “This doesn’t happen here — people keep on trying until the last day and then catch a flight out. Partners, creditors, employees are all left unhappy and now have a horror story to share. These failures can make it appear as though start-ups and entrepreneurship are not a legitimate undertaking.”

He describes the Middle East’s venture capital firms as being more risk averse than in other regions.

“They tend to think like private equity investors but like to say they’re venture capitalists and expect VC returns. All of us need to change our mindsets to improve the ecosystem,” adds Gulati. “I know of horror stories where VC investors have sued founders when the company failed. They’ve acted as anything but risk-takers and demanded recriminations. These things are common and are the hallmark of an incomplete ecosystem.”

Venture capitalists’ failed investments will probably outnumber their successful ones, so what kind of support should they give to their stable of companies?

“We go into an investment knowing it will either go to zero or hopefully 10–100x. A very small percentage of companies will generate the bulk of the value for VC investors,” says Ramzy Ismail, director of Techstars Dubai. Globally, Techstars, a US-based seed accelerator, has helped more than 1,200 companies raise more than $4 billion in funding.

“Knowing that, you then have to decide how to allocate your time to entrepreneurs. There’s a school of thought that you want to help the companies that are struggling the most to bring up the average — typically seen in angel, accelerator and seed phase investments — or you spend time on the companies that are breaking out and you push those forward.”

More broadly, he urges entrepreneurs to embrace the lessons that failure can provide, with startup post-mortems providing an important learning tool in other regions.

“Reflective and thoughtful communication about failure is a big part of learning from it and unfortunately in Dubai there isn’t this approach,” says Ramzy. “The stigma — and sometimes punishment or consequences — of failure often outweighs the public learnings, leading to a closed loop feedback cycle.”

To gain more insight into why startups fail and key lessons learnt, sign up to Autopsy here: Autopsy Subscriber List

If you have had a past failed startup, we would love to hear from, please submit your Autopsy here: Submit an Autopsy